A document circulating on social media has stirred controversy in Rwanda, as it appears to require couples organizing weddings to submit tax information for all vendors involved in their ceremonies.

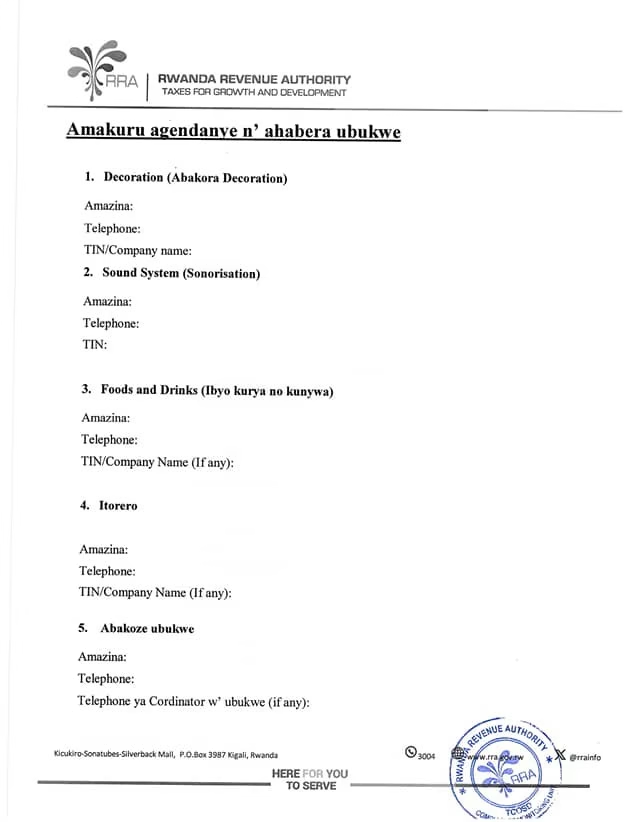

The form, titled “Amakuru agendanye n’ ahabera ubukwe” (“Information related to the wedding venue”), lists sections for decorators, sound system operators, food and drink suppliers, dance troupes, and the wedding coordinator. It requests names, phone numbers, Tax Identification Numbers (TINs), and company names for each service provider.

According to a local media report, tax agents from the Rwanda Revenue Authority (RRA) are now showing up at weddings with the form, requesting it be filled out on-site. The report noted that while taxes on wedding-related services were already part of the law, they had not been actively enforced until now.

The RRA has not officially confirmed or deny the document’s authenticity. However, in response to an X (formerly Twitter) user who posted a photo of the form, the agency replied: “Can you give us the details who gave you this form so that we can follow up thank you.”

The post followed a complaint by a user who said he had been asked to fill out the form, including the name of his emcee (MC), and that vendors were now charging an additional 30 percent to cover taxes. “We who have booked ahead of time now the prices are changing and we are asked to add 30 percent for the revenue,” the user wrote.

The development has sparked widespread reaction online, with some expressing concern over what they see as overreach into private events, while others questioned the clarity and fairness of implementation.

The form does not specify whether its use is mandatory, nor does it outline enforcement mechanisms. Still, it appears consistent with broader government efforts to formalize the informal economy and improve tax compliance across sectors.

As of Monday, the RRA had yet to issue a formal statement addressing the concerns.